by Navatar Marketing | Aug 28, 2025 | Private Equity

Intro: Why Data Chaos Holds Private Equity Back Private equity firms are excited about AI — and rightly so. Done right, it could mean better deals, smarter fundraising, and faster insights. But here’s the problem: if your CRM is a mess, AI doesn’t help. Bad data +...

by Navatar Marketing | Jun 30, 2025 | M&A, Private Equity

For years, CRM in private markets was treated as an operational task. Partners delegated it to junior team members, who tried to mold their workflows around rigid systems—tracking pipelines and chasing efficiency. The result? A patchwork of over-engineered tools that...

by Navatar Marketing | May 29, 2025 | M&A, Private Equity

At Navatar, we welcome competition—it drives innovation and pushes us all to better serve our clients. But we also believe that comparisons should be rooted in truth, not fiction. Recently, Affinity published two articles—”Top Navatar Alternatives” and “Is...

by Navatar Marketing | May 7, 2025 | M&A, Private Equity

If you’re exploring DealCloud alternatives, you’re likely in the market for a CRM platform purpose-built for private markets. While DealCloud has earned recognition in the private equity and investment banking space, it isn’t the only option. Your...

by Nicholas Donato | Feb 26, 2021 | Asset Management, Fund of Funds, Private Equity

Now that one in five venture capital exits goes to private equity, the industry has a golden chance to tap the ballooning VC-to-PE deal pipeline for exclusive referrals . By October of last year, private equity sealed more than 800 deals from this emerging channel,...

by Cindy Cao | Apr 13, 2020 | Asset Management, Fund of Funds, Mezzanine, Private Equity, Venture Capital

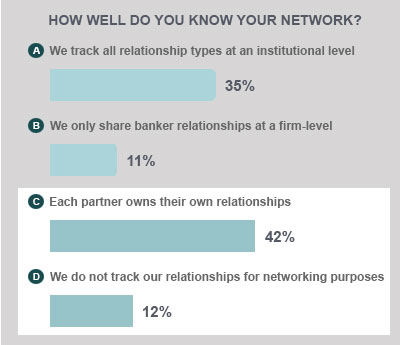

More than 50% of private equity firms do not leverage their own network that can help them source off-market deals, according to a survey that was part of Navatar’s roundtable hosted with ACG. Most firms struggle with institutionalizing their relationship data (as...