by admin | Dec 8, 2021 | M&A

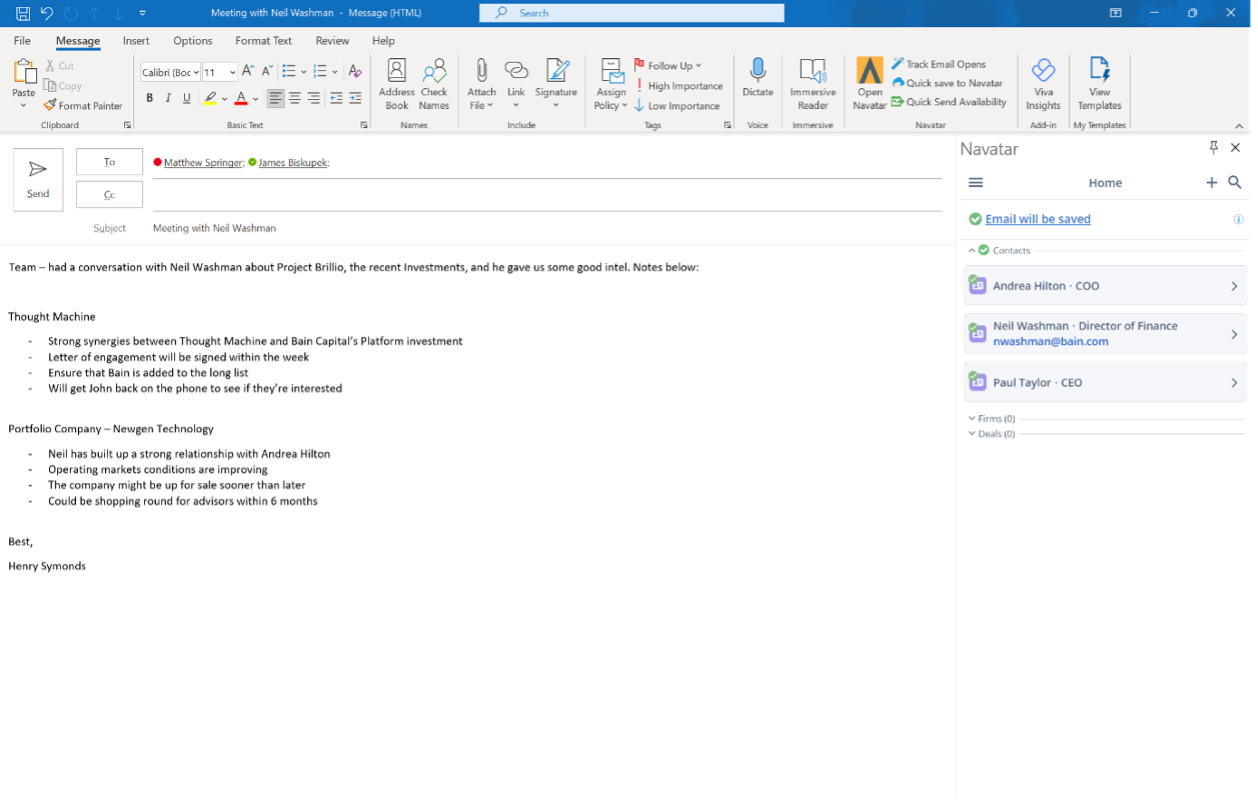

Investment bankers have been busy with meetings in this hot M&A market ($2.5 trillion of deals in the first half of the year alone). Most of the meetings uncover valuable information related to potential opportunities and buyers – however, a lot of this data,...

by Cindy Cao | Apr 1, 2021 | Asset Management, Fund of Funds, M&A, Mezzanine, Placement Agent, Private Equity, Private Equity Real Estate, Venture Capital

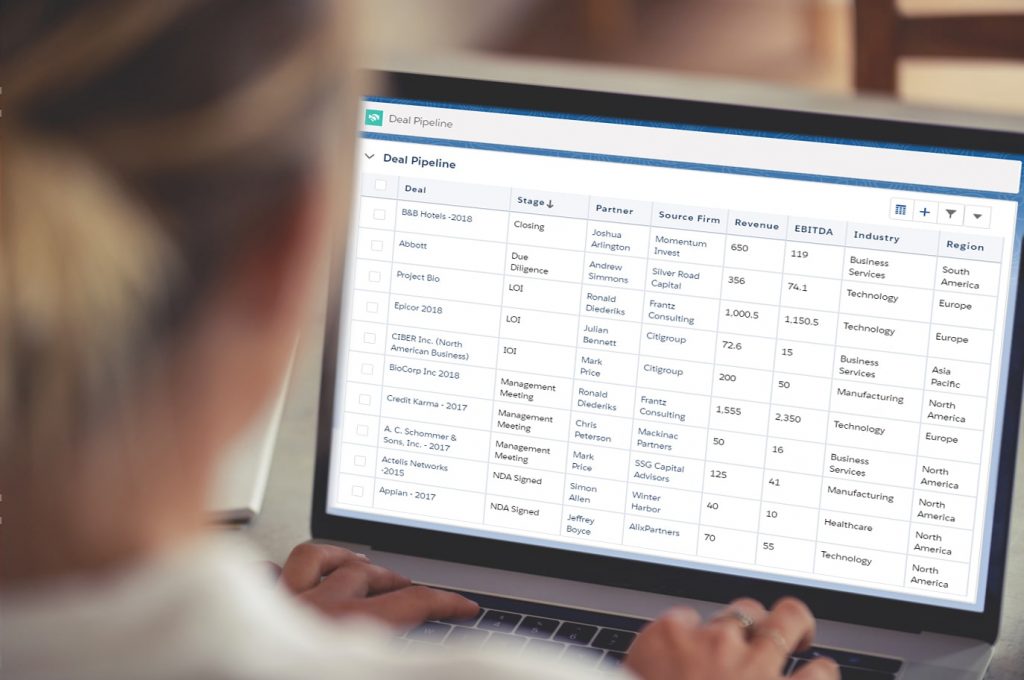

We’ve designed our private equity software to combine the best of both worlds – dealmakers can enter data using Excel or our Excel-like interface, which is synced to our CRM. Here’s a quick look: 1. Keep using Excel – No need to change your current workflow....

by Cindy Cao | Feb 16, 2021 | Asset Management, Fund of Funds, M&A, Mezzanine, Placement Agent, Private Equity, Venture Capital

You and your colleagues have an entire ecosystem of relationships to draw deals from, but rarely is this mapped out to easily see who knows who for warm intros and more referrals. Fortunately this ‘network mapping’ can be automated through CRM. Each person’s...

by Cindy Cao | Jan 3, 2018 | Asset Management, Fund of Funds, M&A, Mezzanine, Placement Agent, Private Equity, Private Equity Real Estate, Venture Capital

As private equity and M&A advisors become increasingly marketing-focused, they need software to send mass emails, newsletters, thought leadership pieces and signed deals. But many are unsure what kind of software to buy, since they come in so many labels such as...

by Matt Springer | Oct 26, 2017 | Asset Management, Cloud Computing, Fund of Funds, Hedge Fund, M&A, Mezzanine, Private Equity, Private Equity Real Estate, Venture Capital

As an experienced London-based cloud professional, who frequently travels to New York, I’ve noticed that on average, US investment firms seem to be more tech-savvy than their London counterparts. A US-based investment banker can work on their deals right from their...

by Nicholas Donato | Oct 9, 2017 | Fund of Funds, M&A, Mezzanine, Private Equity, Venture Capital

It is no secret that M&A advisors and private equity firms are putting more effort in demonstrating strong industry background to their prospects. A recent Navatar poll of M&A advisors discovered that more than half of advisors consider the firm’s sector...